The Range Of Services Offered By Tax Professionals In San Diego

Table of ContentsChoosing The Right Income Tax Service ProviderTailored Tax Solutions For Individuals And BusinessesFinding Your Ideal Tax Accountant In San DiegoSan Diego Tax Management: Strategies For Streamlining Your FinancesUnlocking Financial Success With San Diego Tax SolutionsEfficient Tax Management Techniques In San DiegoThe Role Of Tax Professionals In San Diego's Thriving EconomyEasy Steps To Accurate And Timely Tax FilingLeveraging San Diego Small Business Tax Experts For Success

Examine the tax preparer's qualifications to make sure the tax preparer fulfills your particular demands. Review the tax obligation preparer's history with these numerous licensing authorities: California Board of Book-keeping for certified public accountants (Certified public accountants) and also accountants (PAs). California Tax Obligation Education And Learning Council (CTEC) for CTEC-registered tax preparers (CRTPs). Internal Revenue Service (INTERNAL REVENUE SERVICE) Return Preparer Office of Registration for registered representatives (EAs).Avoid tax obligation preparers that hand over work to someone with less experience or knowledge. Ask if the tax preparer has a professional organization affiliation.

The Range Of Services Offered By Tax Professionals In San Diego

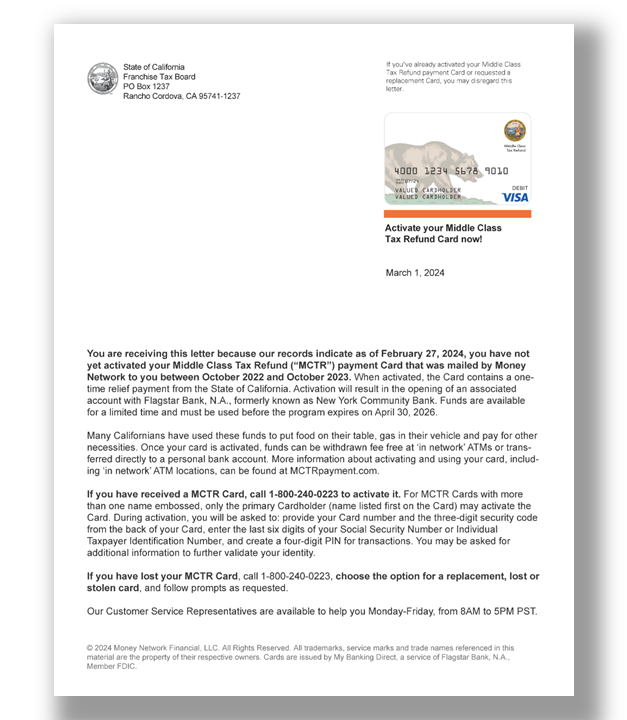

Select a tax preparer who can assist you if the Internal revenue service or the Franchise Business Tax Obligation Board (FTB) get in touch with you or investigate your tax return. An excellent tax obligation preparer must clearly respond to any concerns regarding your tax obligation return.

Comprehend the fees as well as interest rates tax obligation preparers might charge on Refund Anticipation Loans (RALs). All paid tax obligation return preparers are called for to obtain a Preparer Tax obligation Recognition Number (PTIN) from the Internal revenue service as well as restore it each year.

Comprehend the fees as well as interest rates tax obligation preparers might charge on Refund Anticipation Loans (RALs). All paid tax obligation return preparers are called for to obtain a Preparer Tax obligation Recognition Number (PTIN) from the Internal revenue service as well as restore it each year.Leveraging San Diego Small Business Tax Experts For Success

Does not give you a duplicate of your income tax return. Does not work out due persistance in tax obligation return prep work. Charges unprincipled tax return preparation charges. Asks you to authorize an empty tax obligation return, or sign an income tax return in pencil. Does not supply a PTIN on your tax obligation return. Refuses to authorize your tax obligation return or finish the necessary tax obligation preparer information.

Internet site Go to irs. gov and also look for. Phone (800) 829-0433 Internet Site Most likely to and look for. Phone (800) 540-3453 Despite who prepares your income tax return, you are legitimately liable for its precision. The regulation needs a paid tax preparer to authorize your income tax return and complete the info in the space supplied for paid tax obligation preparers.

The Range Of Services Offered By Tax Professionals In San Diego

Call the proper California or government licensing or regulative agencies: Licenses as well as controls The golden state Certified public accountants and . Site Phone (916) 263-3680 Signs up California tax obligation preparers not otherwise managed. Web Site Phone (877) 850-2832 Enrolls and also controls EAs. Website Most likely to irs. gov as well as search for. Phone (855) 472-5540 Licenses and also manages California lawyers.

If you believe all tax obligation preparers are produced equal, Jeffrey Timber wants you to recognize this: "They are definitely not." Wood is a financial advisor and companion at Lift Financial in South Jordan, Utah, in Our site addition to a cpa. Yet he says that classification doesn't necessarily indicate he's the very best person to prepare tax obligation returns.

Discover The Best Tax Services In San Diego

What's even more, some tax specialists prepare returns just in the spring, while others use even you can find out more more detailed services to their customers. Lots of individuals wonder: Just how do I locate a great tax professional near me?

What's even more, some tax specialists prepare returns just in the spring, while others use even you can find out more more detailed services to their customers. Lots of individuals wonder: Just how do I locate a great tax professional near me?Compare charges (San Diego corporation tax preparation). The first step to locating the best tax expert is to recognize what services you need. Some people have standard tax returns, while others may require a preparer who can take care of complex tax scenarios as well as be offered for examination throughout the year.

Top 10 Tax Services San Diego: Your Guide To Finding The Best

Those who desire individualized guidance or have complex finances may desire to look for a CPA." Different individuals have various levels of experience," claims Eric Bronnenkant, head of tax for Improvement, an on-line monetary advisory.

Just as clinical specialists specialize, finance experts do. Lots of Certified public accountants concentrate mainly on audits, as well as those who do pick a profession in tax might focus on a specific location such as specific, business or real estate. Similarly, non-CPA tax obligation preparers might have proficiency in some sorts of returns as well as not others.

Proven Methods For Organizing And Managing Your Taxes

That can be handy for finding a tax preparer skilled in your specific demands. A relied on lawyer or insurance agent might additionally have links with experienced tax professionals.

If your network does not have any type of ideal leads, a web search may be your next ideal choice. "That's a bit extra risky because you aren't certain what you're going to obtain," Bohlmann says. A great location to try to find qualified preparers gets on your state's certified public accountant association web site, assuming they have a searchable subscription directory.

Tips For Efficient Corporation Tax Filing

Almost anybody can obtain a PTIN, nevertheless, as well as it's no assurance that a preparer is good at their job or provides the solutions you require. Preparers located chains such as Jackson Hewitt and also Liberty Tax obligation might be able to conveniently handle basic income tax return. They aren't always trained, however, to supply thorough tax obligation guidance.

You can check the IRS site to confirm a person's credentials, Wood says. You can discover a whole lot from online testimonials, however absolutely nothing replaces an individual discussion. This is specifically important if you're searching for somebody to partner with for the long-lasting. Tax obligation time is busy, so don't anticipate a lengthy conversation if you're searching for a tax professional in the spring, yet ask for a five- to 10-minute phone call at the very least.

Comparing Services And Expertise Among Top Tax Firms

That implies preparers that make use of paper returns might be doing taxes on a part-time basis which could be an indicator to maintain looking, regardless of exactly how remarkable a person's credentials may be. In huge accounting firms, there may be numerous staff members that can be functioning on your tax return, from CPAs to junior employee.